Give your business

and clients higher yields.

Generate up to 240% steady returns by providing liquidity and growing your funds securely.

Diversified Liquidity Participation

This multi-venue approach captures fee revenue, market-making spreads, trading and lending returns—reducing single-source risk while maximizing yield opportunities.

Institutions benefit from a diversified, operationally managed strategy that blends traditional exchange liquidity with DeFi primitives for more resilient, higher-performing returns.

Grow Client Portfolios with Consistent Returns, Effortlessly

Institutions can integrate Propline into client portfolios to enhance yield performance without speculative exposure. Our 10% monthly return model offers a sustainable, structured growth pathway over 24 months—allowing fund managers to scale predictable income streams and strengthen client confidence.

Propline provides clear, auditable reporting and frictionless withdrawals for efficient portfolio operations.

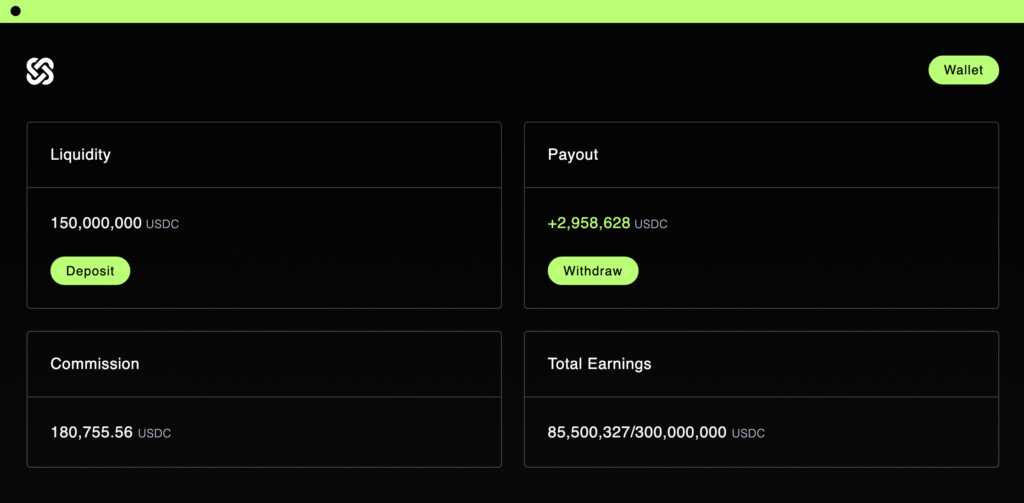

Institutional Partnership and Treasury Solutions

Propline offers tailored liquidity programs and API access for institutional partners. Whether managing client funds, corporate treasuries, or fintech platforms, institutions can deploy and monitor large-scale liquidity positions with automated performance tracking, multi-wallet management, and customizable reporting.

Partnering with Propline delivers a secure, compliant, and scalable vehicle to optimize yield across your organization.